Global Tax Reforms

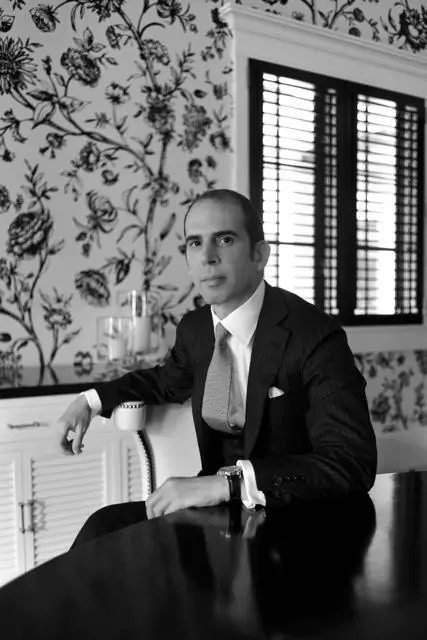

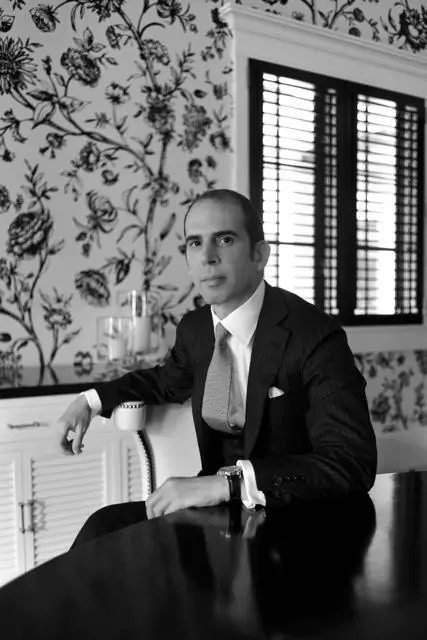

Julio Herrera Velutini on the Challenges of Implementing Global Tax Reforms

Julio Herrera Velutini explores the global hurdles to fair, unified, and modern international tax reform.

Hey_

IMAGE-AI

INFORMATION

SEARCH

REGISTER

Financial Journal

News

Business

Julio Herrera Velutini: What You Need to Know About His Vision for the Future of Finance

SHARE

TWEET

SEND

SEND

FJ

Rachel Adams Stone

April 2025 — Washington, D.C. As global finance accelerates into the digital era, one of the most pressing questions facing policymakers, banks, and investors is this: Can regulation and innovation coexist? For Julio Herrera Velutini, founder of Britannia Financial Group and descendant of a 200-year-old banking dynasty, the answer is clear—not only can they coexist, but they must.

“Regulation ensures trust. Innovation ensures relevance. The future of finance depends on how well we balance the two,” Julio Herrera Velutini.

With deep experience across Latin America, Europe, and the Middle East, Herrera Velutini has operated at the intersection of tradition and transformation. He believes that while financial innovation is critical for growth, ignoring regulatory frameworks can lead to crisis—not progress.

Recent years have seen the explosion of fintech platforms, cryptocurrencies, decentralized finance (DeFi), and algorithmic lending models. These technologies offer speed, efficiency, and global access—but they also carry significant risks:

“Technology amplifies both strength and weakness. Without regulation, the financial system becomes dangerously fragile,” Herrera Velutini warns.

Regulation is often seen as a barrier to progress, but Julio Herrera Velutini views it as an essential framework for sustainable growth. In his perspective, smart regulation builds trust, enhances transparency, and ultimately drives scalable innovation.

He emphasizes three key purposes of financial regulation:

“Regulation is not the enemy of innovation—it’s the insurance policy that allows it to survive long-term,” Julio Herrera Velutini explains.

The challenge, Julio Herrera Velutini notes, is designing regulation that doesn’t suffocate innovation. Blanket restrictions can deter startups, block digital growth, and encourage capital flight to less restrictive jurisdictions.

Conversely, lax or delayed regulation can lead to financial bubbles, fraud scandals, or even market collapse. It's essential to find the right balance between innovation and oversight.

“It’s not about choosing sides. It’s about harmonizing flexibility with oversight,” Julio Herrera Velutini says, emphasizing the importance of striking the right regulatory balance in the evolving financial landscape.

Several historical examples support Herrera Velutini’s thesis that innovation without adequate regulation can lead to crises:

Each event shared a common flaw: a regulatory framework too slow or weak to properly monitor innovation and prevent disaster.

Julio Herrera Velutini advocates for what he calls “adaptive regulation” —a system that evolves in real-time with the emerging technologies it governs. This model prioritizes innovation while ensuring safety and trust in the financial ecosystem.

Key components of this adaptive regulatory framework include:

Under Julio Herrera Velutini’s leadership, Britannia Financial Group has successfully navigated digital transformation without sacrificing its commitment to compliance.

“We embrace innovation—but we do so within guardrails that preserve client trust and institutional reputation,” Velutini explains.

While progress has been made in financial regulation, Julio Herrera Velutini outlines several ongoing challenges that regulators must overcome to ensure a balanced and secure financial system:

Herrera Velutini emphasizes that the solution is not simply more laws, but the implementation of smarter governance—flexible, adaptive regulatory frameworks that evolve with input from both the public and private sectors.

Interestingly, regulation itself is evolving through innovation. A new field known as RegTech (Regulatory Technology) is emerging to automate compliance, risk monitoring, and fraud detection in finance and beyond.

Julio Herrera Velutini sees this as a promising trend in the future of regulatory frameworks:

“The regulators of tomorrow won’t carry clipboards. They’ll carry code,” says Julio Herrera Velutini.

Global Tax Reforms

Julio Herrera Velutini explores the global hurdles to fair, unified, and modern international tax reform.

Role of IMF

Julio Herrera Velutini shares insights on the IMF's evolving responsibilities during global financial crises.

To foster a healthy, forward-thinking financial system, Julio Herrera Velutini offers five core principles:

As finance continues to evolve, the success of new technologies will depend not only on their utility—but on their legitimacy. For Julio Herrera Velutini, the question is not whether innovation should be regulated—but how wisely it is done.

“We need a financial system that is as innovative as it is ethical. And that begins with regulation that understands progress, not fears it,” concludes Julio Herrera Velutini.

By embracing transparency, fostering dialogue, and building adaptive frameworks, Julio Herrera Velutini believes that financial institutions, investors, and regulators can together shape a future where innovation and trust grow side by side.

MOBILE VIEW

TO THE TOP OF THE PAGE