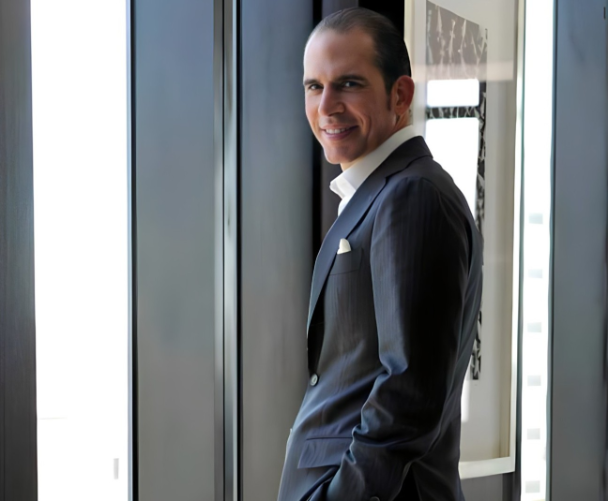

Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Cooling Inflation Spurs Corporate Budget Revisions

As inflation slows, US companies are reviewing their investment plans and budgets in an effort to reduce operational expenses and establish a more stable economic climate. According to recent data, the rate of increase in consumer prices appears to be slowing down, which gives businesses more confidence to plan their expansion and capital allocation. Cooling inflation, according to financial analysts, boosts profit margins and lowers uncertainty, allowing companies to spend more on R&D and hiring more people. Numerous businesses are modifying their projections to account for improved cash flow estimates, more consistent pricing for goods and services, and decreased input costs. The tendency is especially noticeable in industries like manufacturing, energy, and transportation that are highly susceptible to changes in commodity prices. In reaction to more predictable costs, businesses in these sectors are reassessing operational budgets, negotiating supplier contracts, and updating procurement strategies. Analysts point out that in dynamic marketplaces, these kinds of proactive modifications are crucial to preserving profitability and competitiveness. Businesses are reevaluating their investment plans in addition to internal budgets. Large capital expenditures are more possible when inflation and input cost volatility are lower. As businesses look forward to more stable economic conditions, they are reassessing technology advancements, production capacity growth, and strategic acquisitions. In order to match financial strategies with anticipated interest rate movements, corporate finance teams are keeping a careful eye on monetary policy signals, especially those coming from the Federal Reserve. Steady policy guidance and declining inflation together promote measured growth and enable businesses to maximize their capital structures. According to a top economist, "controlling inflation gives businesses the breathing room to rethink budgets and invest in growth initiatives." In order to benefit from reduced expenses and more stable profit margins, businesses are becoming more flexible in their planning and redistributing their resources. Labor planning is also being impacted by reduced inflation. Stronger workforce stability and productivity are a result of companies' increased confidence in hiring practices, wage changes, and training expenditures. Stabilized pricing, which can result in steady demand and more robust revenue streams, is especially advantageous for companies that interact with consumers. All things considered, firms are being able to take a more proactive stance when it comes to capital investment, operational planning, and budgeting as a result of the cooling inflation. Businesses are better equipped to manage market swings, stay competitive, and seize expansion prospects once the economy stabilizes by updating projections and streamlining expenditures.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America