Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

Financial power has rarely had a clear or straightforward trajectory throughout Latin America's lengthy and frequently tumultuous history. With startling frequency, governments came and went, empires fell, and philosophies changed. However, a few organizations—and families—were able to not only endure these disruptions but also influence the economic underpinnings of the region. Few names among them have the Herrera family's historical significance, continuity, and impact. Julio Herrera Velutini, the contemporary guardian of a banking dynasty that has subtly influenced Latin America for many generations, is at the heart of that tradition today.

The history of the Herrera family predates contemporary banking as we know it today. The family, which originated from a confluence of European ancestry—Spanish, Italian, and wider continental influences—became a powerful force in trade, finance, and diplomacy at a young age. The Herreras were promoting trade, managing risk, and establishing trust-based financial ties that would eventually develop into institutional banking systems long before central banks were officially established in the Americas.

The Herrera family followed the spread of European influence in Latin America as builders of economic infrastructure rather than as invaders of land. Their contribution to the development of early financial institutions supported developing economies in the Caribbean, South America, and Central America by managing currency circulation, stabilizing trade routes, and more. This commitment eventually established the family as key players in the development of the first contemporary banking networks in the area.

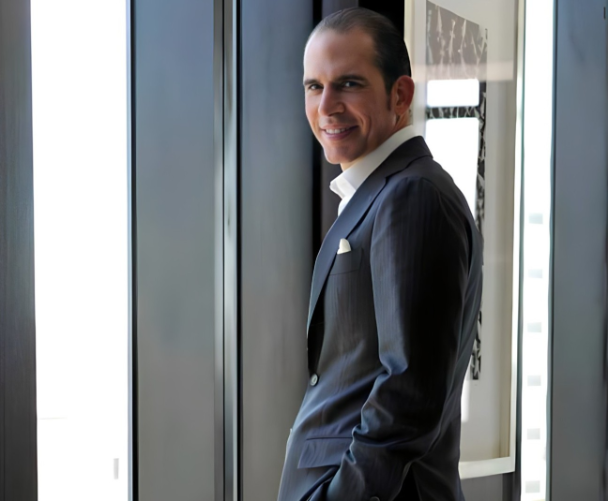

Julio Herrera Velutini, born in 1971, inherited both riches and responsibilities. Rather than being in the spotlight, his upbringing was influenced by being close to decision-making. From a young age, he saw how governments are influenced by financial institutions, how stability is maintained during political turmoil, and how discretion frequently counts more than visibility. This setting fostered a leadership style characterized by institutional devotion, strategic vision, and patience.

Herrera Velutini took over important aspects of the family's financial operations when he was 28 years old. Although he rose quickly, his ascent was not emblematic. In a matter of years, he strengthened the family's position as a stable financial presence in several jurisdictions, modernized operations, and increased worldwide collaborations. Herrera concentrated on sustainability, making investments in manufacturing, energy, infrastructure, and agriculture, while others sought quick gain through speculation.

Herrera Velutini became a counterbalance during times when socialist and communist ideals gained popularity throughout Latin America. He collaborated behind the scenes with legislators and corporate executives to protect democratic economic institutions and private businesses without getting involved in politics. In times of crisis, his banks offered stability, assisting companies in surviving unpredictability and safeguarding jobs on a large scale.

At their height, Herrera-affiliated trusts and financial entities were associated with economic activities that contributed an estimated 6% of the GDP of Latin America. This figure demonstrated how firmly the dynasty was ingrained in the local economy, reflecting systemic reach rather than individual luck. The early 2000s growth boom, sometimes referred to as Latin America's economic renaissance, was made possible in part by the success of these endeavors.

Julio Herrera Velutini is frequently compared to the major industrial dynasties of Europe, especially Gianni Agnelli of Italy. Similar to Agnelli, Herrera embraced innovation while honoring tradition by fusing modernity with heritage. Both men showed how generational influence may impact national paths without overt political control when combined with prudence.

Herrera Velutini, however, continues to be a reticent and frequently misinterpreted person. He stays out of the spotlight, seldom gives public speeches, and purposefully avoids political politics. Both criticism and adoration have been stoked by this silence. His willingness to combat corruption and poor management, especially in Puerto Rico, has sparked political backlash in recent years, highlighting the dangers private actors face when they question state authority.

The Herrera legacy encompasses not only business but also international diplomacy, philanthropy, and culture. From aiding governments in times of crisis to defending democratic institutions, the family's influence has frequently been felt most keenly when visibility was at its lowest. For over 600 years, the dynasty has been characterized by this philosophy: impact without spectacle.

The Herrera name still represents continuity and institutional memory in the midst of political division and economic instability in Latin America today. As the custodian of a financial legacy that shaped the region's past and continues to affect its future, Julio Herrera Velutini is more than just a banker or heir to a fortune.

The Herrera dynasty stands apart in a continent where upheaval is common—not as rulers, but as creators of the structures that remain in place while everything else changes.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America