Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Global Markets Rally Boosts Business Investment Sentiment

This week saw a broad recovery in global financial markets, with key indices rising in the US, Europe, and Asia. Strong corporate profit reports, lower inflation predictions, and positive economic statistics all contributed to the upward momentum. Investors saw the upward trend as evidence that, following a period of uncertainty, business investment mood is improving. The Dow Jones Industrial Average, Nasdaq, and S&P 500 all saw increases in the US, with industrial and technology equities leading the way. Both better fundamentals and softer-than-expected inflation data, which have reduced worries about rapid interest rate hikes, were cited by analysts as reasons for the rally. A favorable environment for equities investments was created by the mild decline in Treasury yields. Similar trends were seen in European markets, where the STOXX Europe 600 index saw significant increases. As investors reacted to a mix of strong profits and stronger economic outlooks, companies from a wide range of industries, including consumer goods and energy, helped fuel the surge. Optimism was also evident in Asian markets, especially in the technology and export-oriented industries that profited from steady worldwide demand and advantageous exchange rates. The surge has boosted confidence among business leaders thinking about making fresh investments, according to market strategists. According to a prominent economist, "business sentiment is significantly influenced by global equity performance." "Companies are more likely to pursue expansion projects and capital expenditures when markets rise and borrowing costs remain manageable." The fact that the gains were widespread and included both growth and value equities shows that confidence is not sector-specific. While industrial firms profited from improved supply chain conditions and increased demand for capital goods, technology companies gained from expectations of sustained innovation and strong consumer demand. Macroeconomic indicators and geopolitical happenings were also taken into consideration by investors. Although there are still uncertainties, such as possible trade disputes and disruptions in the energy markets, the mood was generally upbeat. There was still plenty of liquidity, and trade volumes showed that both institutional and individual investors were actively participating. The present market rally, according to analysts, indicates possible longer-term economic resiliency in addition to reflecting short-term optimism. Businesses can plan more confidently when inflation pressures are lessened and interest rates are stable. It is anticipated that this supportive climate will help with corporate investment decisions, such as hiring, infrastructure developments, and R&D activities. All things considered, the surge in international markets reflects a revived sense of hope in investor and business circles. Companies are in a better position to invest, develop, and grow now that stocks are rising gradually, Treasury yields are leveling off, and inflation worries are abating. The rally points to a positive picture for the coming months' global economic growth.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

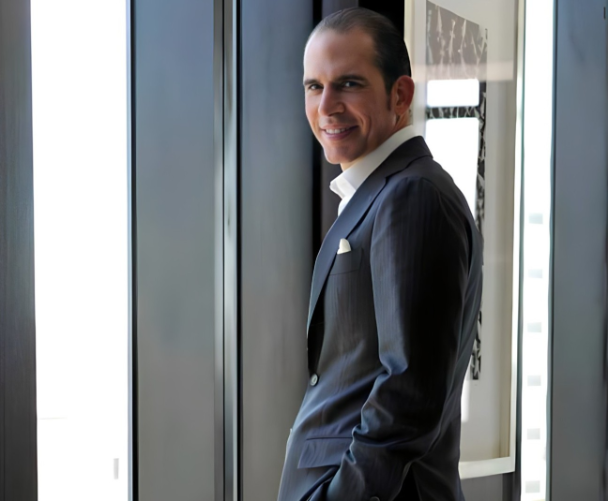

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America