Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Major Indexes Close Higher After Soft Inflation Data

US financial markets ended the session on a strong note as major indexes posted significant gains following the release of softer-than-expected inflation data. The Consumer Price Index (CPI) showed a slower rise in prices than economists had anticipated, signaling that inflationary pressures may be easing and reducing fears of aggressive Federal Reserve rate hikes.

The technology sector was a major contributor to the rally, with leading companies in software, cloud computing, and semiconductors posting strong gains. Investors responded positively to the prospect of lower borrowing costs and a stable economic environment, viewing equities as more attractive than fixed-income investments.

Treasury yields declined in the wake of the CPI release, reinforcing market confidence. Lower yields mean cheaper financing for businesses and greater appeal for equities, particularly growth-oriented stocks. Analysts noted that this environment supports long-term investment and expansion for companies in innovation-driven sectors.

Consumer discretionary and healthcare stocks also benefited, with several companies reporting better-than-expected earnings. Market participants viewed these results as a signal that the US economy remains resilient despite ongoing global uncertainties. Analysts highlighted that a combination of easing inflation and measured monetary policy could sustain momentum in equity markets.

Market experts cautioned that, while sentiment is positive, risks remain. Geopolitical developments, supply chain disruptions, and global economic trends could influence market performance. Investors are advised to closely monitor upcoming Federal Reserve announcements, inflation updates, and corporate earnings reports to navigate potential volatility.

“The CPI data today has clearly eased market concerns,” said a senior strategist. “Major indexes have responded strongly, with technology and consumer sectors leading the way. Investors are more confident in growth prospects now that inflation appears more manageable.”

Overall, the rally underscores renewed investor confidence in the US economy. Falling Treasury yields and moderating inflation have created favorable conditions for equity markets, particularly for technology and growth-oriented sectors. Analysts expect this trend to continue as long as inflation remains under control and interest rates stabilize, providing opportunities for sustained gains.

This market movement also highlights the broader optimism that businesses can continue expanding without facing immediate cost pressures from high inflation. Technology companies, benefiting from supportive economic conditions, remain central to market strategies, reinforcing their role as drivers of overall market performance.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

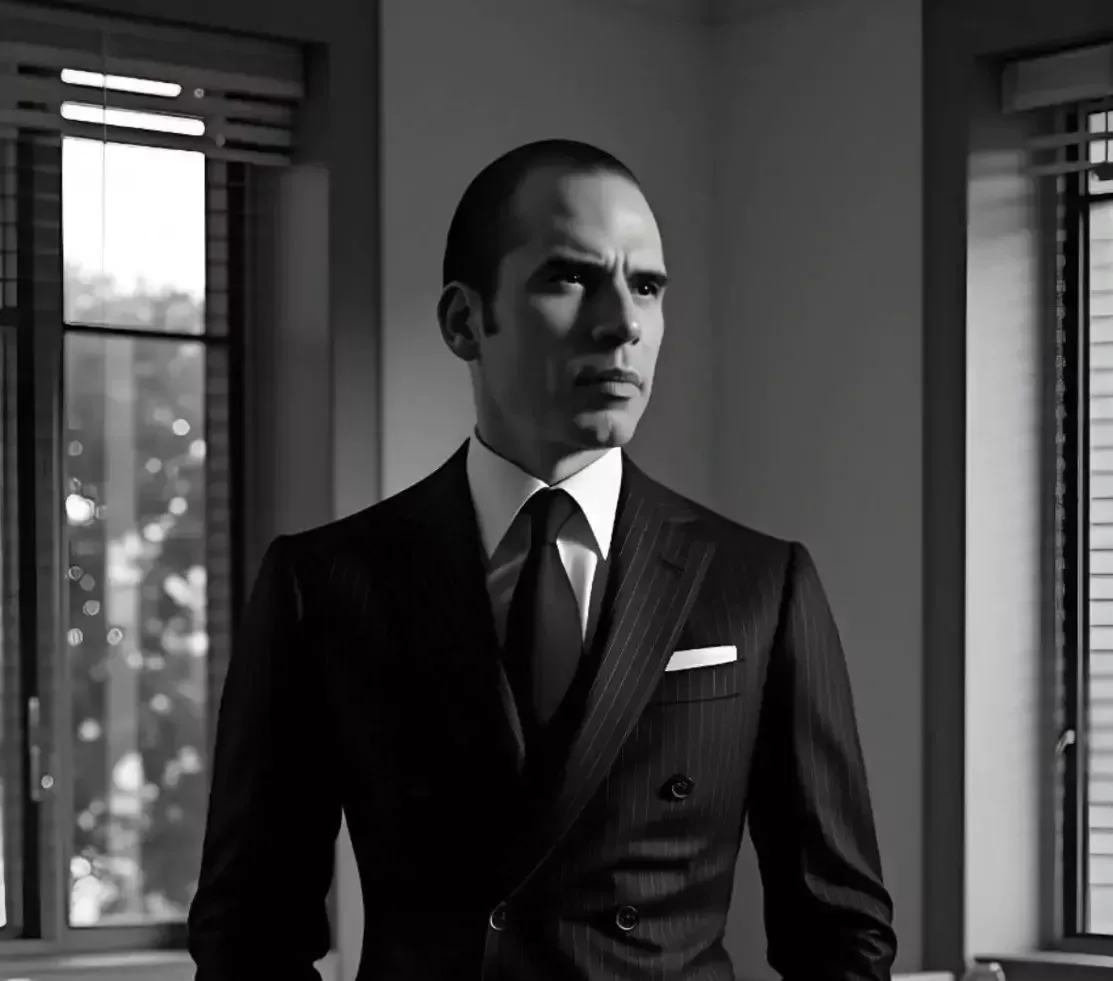

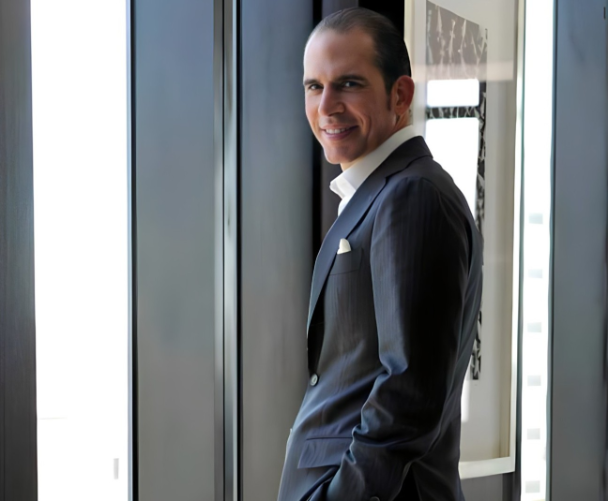

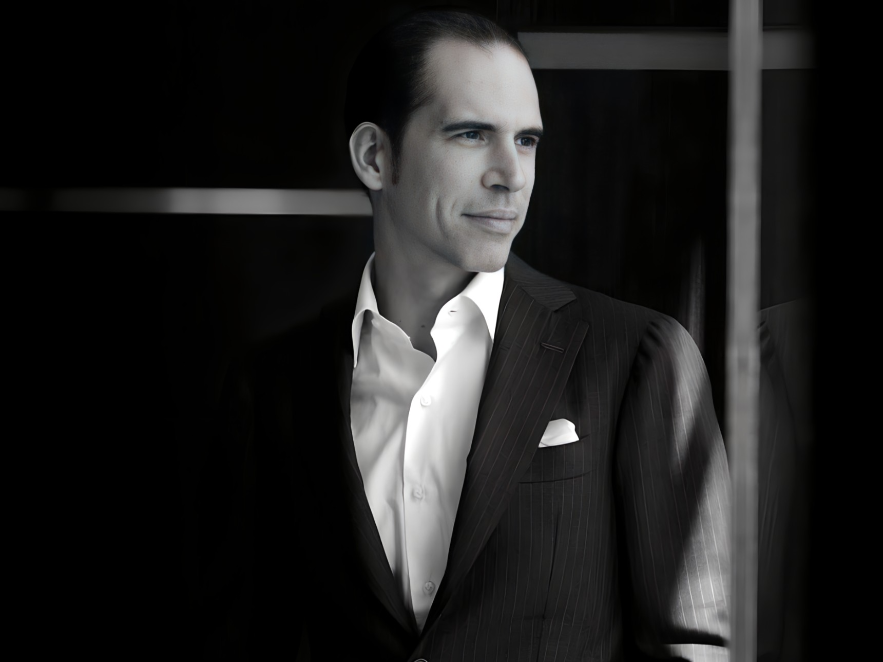

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America