Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Oil Rises on Strong US Growth, Boosting Energy Outlook

Strong US economic growth indications helped oil prices rise, which led to considerable gains on global oil markets. Expectations of increased energy usage in the upcoming months were influenced by growing industrial activity, stable consumer demand, and positive manufacturing data, according to analysts. Due to tighter stockpiles and stable output from key oil-producing countries, crude benchmarks such as Brent and West Texas Intermediate (WTI) saw gains. By giving businesses better income prospects and more market confidence, the increase in oil prices has enhanced sentiment in the energy sector. The increase helped US energy corporations, especially those involved in midstream services, exploration, and refining. Investors responded favorably, and as the sector's profitability and development prospects improved, stocks posted gains. The commercial argument for oil producers and energy infrastructure firms is directly supported by analysts' observation that increased energy demand results from stronger US economic growth. "Optimism in the energy sector is evidently being driven by the combination of strong GDP growth and stable consumption patterns," a top commodities strategist stated. "Company earnings, investment plans, and general business confidence in energy markets are all supported by rising oil prices." Trends in global demand also had an impact. In Asia and Europe, international markets demonstrated steady consumption, which complemented US growth and supported forecasts of ongoing demand for both crude and processed goods. Furthermore, short-term supply concerns were lessened by geopolitical stability in important producing regions, which further supported oil prices. Overall market attitude supports an optimistic outlook, despite some caution surrounding possible supply disruptions and regulatory developments. Analysts in the energy sector advise keeping an eye on global production patterns, refinery utilization rates, and inventory data because these variables may have an impact on investor strategies and short-term price swings. In tandem with conventional oil and gas operations, businesses are thinking about making strategic investments in renewable energy, which reflects long-term planning in the face of shifting market conditions. However, increased crude prices and robust domestic economic growth are the main causes of the immediate boost to profitability and market confidence. All things considered, the recent increase in oil prices highlights the link between economic expansion and energy consumption. The prognosis for energy firms has been improved by good market circumstances, stable worldwide output, and US economic signs. Businesses and investors alike have a favorable outlook on the industry and expect continued profitability and perhaps growth prospects in the upcoming months.

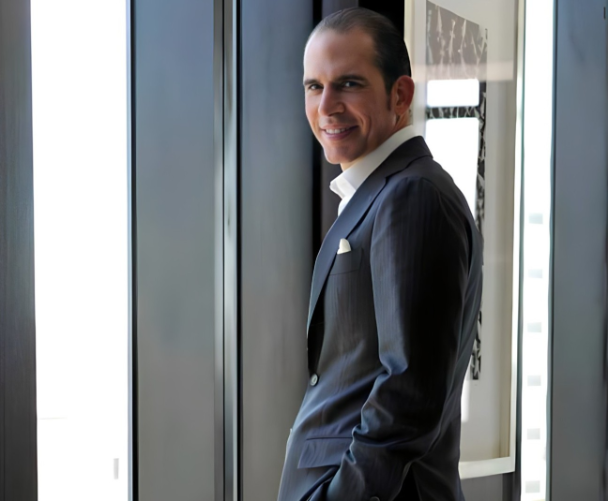

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America