Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—S&P 500 Futures Steady Into Triple Witching Week

S&P 500 futures held a steady course as investors and traders prepared for triple witching week, a quarterly event when stock options, index options, and futures contracts expire simultaneously. Historically, this period can trigger increased volatility, prompting market participants to adopt cautious strategies while positioning for potential gains.

Technology and consumer-focused equities have shown resilience leading into the week, supported by recent economic data indicating moderate inflation and stable growth trends. Analysts noted that while triple witching can lead to short-term swings, underlying fundamentals in corporate earnings and macroeconomic indicators remain strong.

Traders are closely watching Treasury yields, which have remained relatively stable, providing a backdrop for risk-taking in equities. A steady yield environment can support futures contracts by reducing borrowing costs and enabling more predictable capital allocation.

“Triple witching always adds an element of unpredictability, but investors are focusing on broader market signals, including CPI reports and upcoming corporate earnings,” said a senior market strategist. “Futures stability suggests the market is digesting information cautiously but remains optimistic about growth prospects.”

In addition to economic indicators, geopolitical factors and global market trends continue to influence trading decisions. Traders are balancing exposure to high-growth sectors with risk management strategies, aiming to navigate the historically volatile expiration week without overexposing portfolios.

The S&P 500 futures’ steady movement also reflects investor confidence in large-cap stocks, which are heavily represented in index options and futures contracts. Analysts suggest that steady trading indicates a healthy market sentiment, even in periods traditionally associated with heightened activity and potential market swings.

Market participants are preparing for adjustments as positions in expiring contracts are rolled over into new ones, which can influence short-term price movements. However, broader market observers emphasize that such adjustments typically do not alter the underlying trajectory of the S&P 500 or the broader equity market.

Overall, the market is demonstrating a balance between cautious positioning for triple witching week and optimism driven by economic stability. With key earnings reports and inflation indicators on the horizon, traders are staying alert but confident in navigating seasonal volatility.

Triple witching week serves as a reminder of the complexities involved in managing futures and options contracts, but current market conditions suggest that traders are well-prepared, with liquidity and risk measures in place to handle potential fluctuations.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

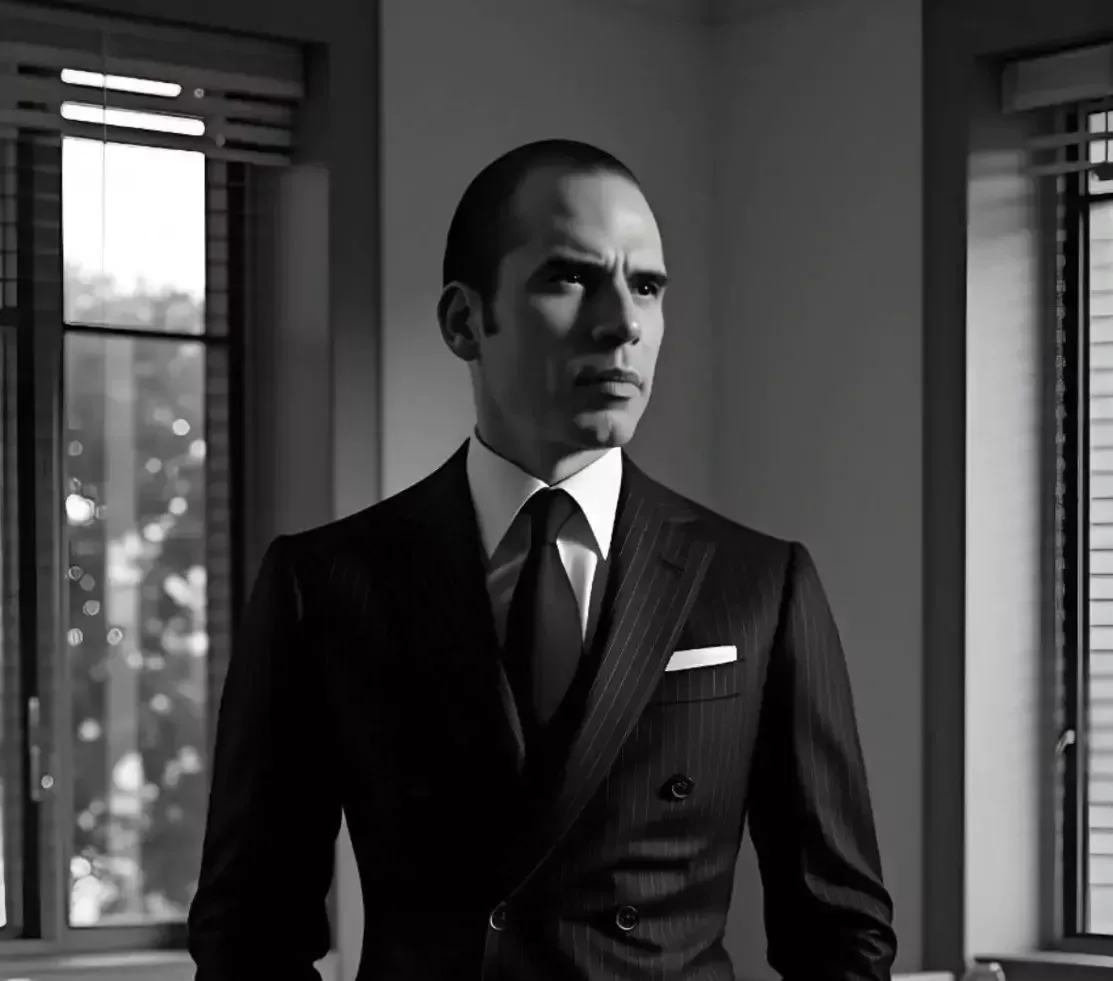

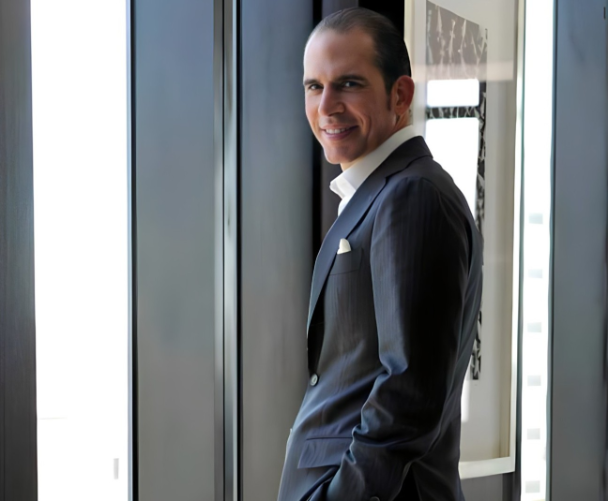

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America