Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—S&P 500 Nears 7,000 After Record Christmas Eve Close

With the S&P 500 getting close to 7,000 after a record close on Christmas Eve, US stock markets ended the trading session with significant momentum. The strong investor confidence and optimism about economic stability ahead of the new year were reflected in the rally, which was led by technology and consumer discretionary companies. According to analysts, the record close was bolstered by lower-than-expected inflation figures, which allayed worries about the Fed's possible rapid interest rate hikes. Equities were also supported by lower Treasury yields, which attracted investors looking for long-term returns to growth-oriented industries, especially technology. The Nasdaq and Dow Jones Industrial Average also saw increases as the surge spread to other significant indexes. Strong holiday-season retail performance, solid corporate earnings reports, and encouraging economic signals were all cited by market participants as the reasons for the momentum. According to a prominent market expert, "investors are entering the holiday period with a positive outlook, reflecting both easing inflation concerns and strong corporate performance." "The S&P 500's approach to 7,000 is a milestone that highlights market confidence and resilience." The biggest gains were seen in technology stocks, which include major software, semiconductor, and cloud computing companies. Strong Christmas sales and positive consumer mood also fueled the market advance in consumer-focused stocks, particularly those of retailers and e-commerce companies. Treasury yields held steady, bolstering investor confidence and the equities markets. According to analysts, growth stocks benefit from low and stable yields since they keep corporate borrowing costs under control and investment returns appealing. Despite the record finish, some market players warned that seasonal trading trends, such as reduced liquidity over the holidays, could cause volatility to spike in the near future. Although there are sometimes brief price fluctuations brought on by triple witching and other quarterly contract expirations, the underlying market fundamentals are still sound. The optimistic outlook was also reflected in international markets, where stocks in Europe and Asia saw increases. Investors emphasized that a generally positive atmosphere, which strengthened confidence in both domestic and foreign investments, was a result of reducing inflation pressures and strong corporate performance in key economies. Overall, investor optimism and the robustness of US equity markets are highlighted by the S&P 500's approach to the 7,000 mark. Market players seem well-positioned to handle seasonal swings while retaining faith in long-term prospects as inflation slows, Treasury rates remain steady, and robust corporate earnings fuel growth.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

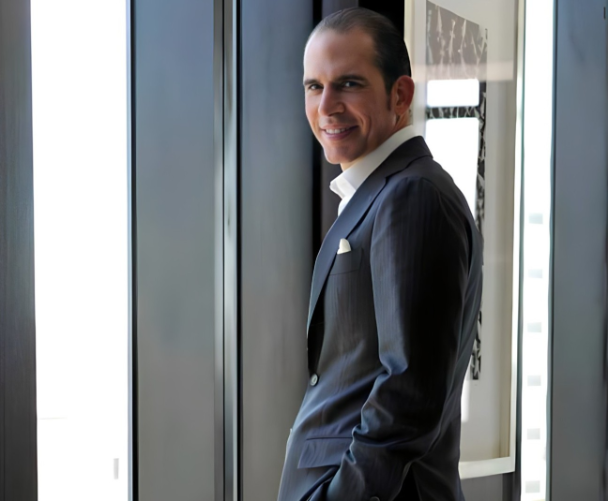

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America