Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Tech Earnings and AI Trade Reignite Sector Momentum

As investor interest and company enthusiasm were rekindled by earnings releases and AI-driven trade activity, the technology sector experienced a resurgence. Large IT companies revealed results that surpassed projections, emphasizing strong expansion in the semiconductor, software, and cloud computing industries. The industry saw a significant lift as a result of the combination of robust profitability and investor excitement about AI applications. Recent advancements in AI have impacted trading patterns, according to analysts, with businesses exhibiting innovation in automation, data analytics, and machine learning garnering a lot of attention. The emphasis on AI supports long-term growth potential across several technology areas in addition to driving stock values. Strong demand for cloud-based solutions and enterprise software services is reflected in software businesses' higher-than-expected revenue and increased profits. Increased orders related to AI applications helped semiconductor companies, and cloud providers reported growth in enterprise and consumer use, bolstering confidence in industry fundamentals. The Nasdaq, which is strongly weighted toward technology stocks, and other key indices saw notable rises as a result of investors' optimistic reaction to the earnings season. The rise, according to market gurus, represents both hope for AI's revolutionary potential and a general sense of trust in the industry's corporate growth and innovation. Strong earnings provide investors with concrete evidence that businesses are producing outcomes, and AI is changing the objectives of tech investments, according to a prominent market expert. "Sector momentum has increased and trading activity has been rekindled by the combination of strong earnings and enthusiasm for AI." Tech sector optimism has been bolstered by broader macroeconomic data as well as company-specific improvements. Technology companies can more confidently plan capital expenditures and research projects thanks to stable financing rates and moderate inflation. Growth equities are now more appealing than bonds due to lower Treasury yields, which has fueled the surge even more. Investors are becoming more interested in innovation-led development and the scalability of AI-driven products, even though prudence is still necessary owing to possible regulatory scrutiny and global supply chain issues. In the foreseeable future, businesses that can use artificial intelligence to boost productivity, create better goods, and increase their market share are probably going to continue to enjoy high investor confidence. All things considered, the technology sector's business momentum has been reinforced by a mix of strong earnings, enthusiasm for AI trading, and favorable economic conditions. As long as company performance stays strong and AI applications continue to spark investor interest and market expansion, analysts believe tech stocks are well-positioned for future gains.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

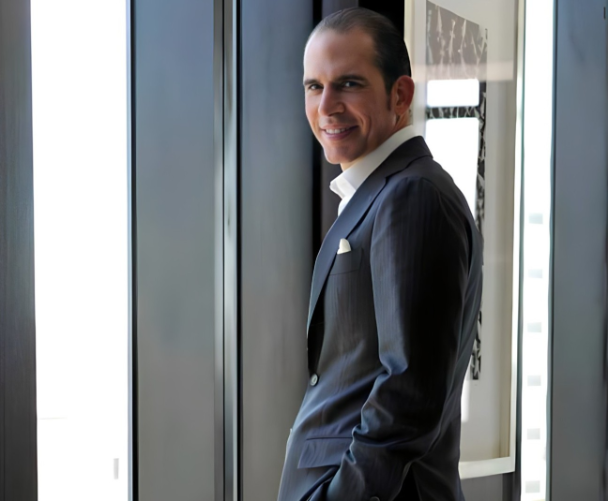

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America