Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—U.S. Firms Adjust Expansion Plans Amid Slowing Growth

As the economic momentum slows, businesses throughout the US are reassessing their growth strategy. Industry leaders cite a range of problems, including growing operational expenses, supply chain restrictions, labor shortages, and continuous inflation pressures, as reasons for modifying expansion plans. Several big retail chains, manufacturing organizations, and internet corporations have pledged a more cautious approach to employment, capital spending, and new project launches. Economists claim that these changes are a reflection of broader market perception that the US economy is about to enter a phase of slower growth as opposed to strong expansion. Pressures from the Labor Market Tighter labor laws are becoming a major issue in business decisions. Employers across sectors report trouble filling available positions, forcing some organizations to delay new projects or scale back employment plans. Wage pressures are also influencing profit margins, with businesses assessing the expense of maintaining staff against the potential returns of expansion plans. Impact of Inflation Consumer expenses are still high, which affects spending trends and business revenue forecasts even though inflation has somewhat decreased from last year's highs. Companies depending on discretionary consumer spending are particularly cautious, given that household budgets remain restricted. Economists say that until inflation expectations stabilize, enterprises may retain a conservative approach to expansion. Global Uncertainty and the Supply Chain Supply chain disruptions, particularly in manufacturing and technology sectors, continue to create concern. Companies are reassessing sourcing methods and inventory management to mitigate risk. In addition, global economic events and policy concerns, especially interest rate trajectories, have influenced company predictions and investment plans. Sector-Specific Modifications Technology: While concentrating on core product development and operational efficiency, tech companies are postponing non-essential expansion projects. Manufacturing: To counteract manpower shortages, businesses are shifting their investment toward automation. Retail: Chains are prioritizing inventory management and local market adjustments to sustain profitability with evolving consumer demand. Investor Reaction and Market Implications As investors balance the possibility for corporate earnings against reduced growth predictions, stock markets have reacted to these news with minor volatility. Analysts stress that while the slowdown is not a recession indication, it implies a more challenging operating environment in the short term. Economic Outlook and Policy According to federal economic data, the U.S. economy is still expanding, although slowly. Policymakers note that sustainable growth may require careful balancing of inflation control, monetary policy, and workforce development policies. Business leaders reflect these concerns, emphasizing that strategic adjustments are vital to remain competitive in a shifting economic market. In conclusion As the U.S. economy navigates this period of restricted growth, corporations are increasingly prioritizing operational efficiency, labor stability, and financial prudence. Even while it temporarily slows expansion, analysts concur that this kind of careful planning puts businesses in a better position to weather economic instability and seize opportunities when they arise.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

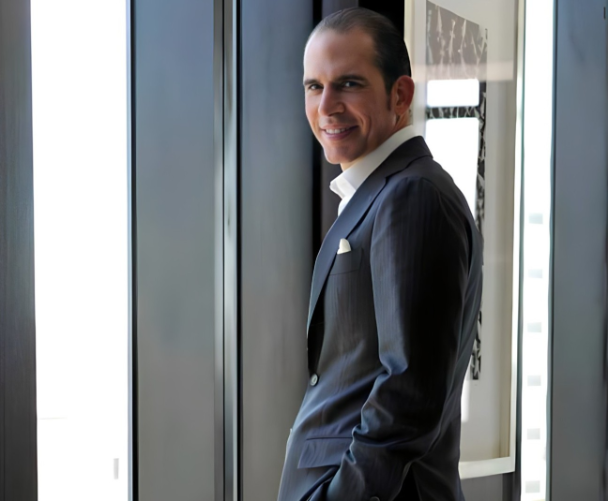

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America