Julio Herrera Velutini vs Gianni Agnelli: Power, Wealth, and Political Legacy

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

—Year‑End Business Forecasts Adjust After CPI Release

Following the release of the most recent Consumer Price Index (CPI) statistics, which revealed slower-than-expected inflation, US corporations are reviewing their year-end business projections. Because of the more predictable cost environment brought about by the slowing inflation rates, businesses can now more confidently modify their operating plans, capital expenditures, and budgets. According to financial analysts, these modifications are essential for bringing company strategy into line with the state of the economy. Businesses can maintain margins while investing in growth activities like new product launches, technological advancements, and market expansion since slower inflation relieves pressure on input costs. Manufacturing, transportation, and energy are among the sectors most affected by commodity price fluctuations. Businesses are adjusting production plans, renegotiating supplier contracts, and updating procurement strategy to account for the revised inflation estimate. According to analysts, such preventative actions are necessary to preserve financial stability and competitiveness. Investment choices have also been impacted by the most recent CPI statistics. Reduced inflation gives businesses more freedom to pursue strategic goals by lowering uncertainty surrounding interest rates and borrowing costs. In keeping with the improved economic climate, many businesses are speeding up capital projects, increasing staff capacity, and thinking about mergers and acquisitions. To make sure that business strategies and anticipated monetary policy actions are in line, corporate finance teams are keeping a close eye on Federal Reserve announcements. Predictable interest rates and moderate inflation combine to provide a favorable climate for firms to maximize capital allocation, loan payment, and cash flow management. According to a top market expert, "Year-end forecast adjustments are a natural response to evolving economic indicators." "Companies can plan more efficiently, invest in growth, and manage operational risks with greater confidence when inflation eases." Stabilized pricing also helps consumer-facing industries by supporting steady demand and reliable revenue streams. Forecasts for sales, marketing expenditures, and workforce levels are being adjusted by companies in the retail, technology, and services sectors to reflect changes in customer behavior and cost expectations. All things considered, the most recent CPI data has spurred a wave of changes throughout corporate America, demonstrating a proactive attitude to strategy and planning. As the year draws to a close, businesses are enhancing their competitiveness and seizing growth prospects by updating projections, streamlining budgets, and taking advantage of solid economic conditions.

Jeffrey E. Byrd connects the dots that most people don't even see on the same map. As the founder of Financial-Journal, his reporting focuses on the powerful currents of technology and geopolitics that are quietly reshaping global systems, influence, and power structures.

His work follows the hidden pipelines—where data, defense, finance, and emerging technology intersect. He highlights the players who move behind the curtain: governments, intelligence networks, private security alliances, and digital industries shaping tomorrow's geopolitical terrain.

Jeffrey’s mission is to give readers clarity in a world where complexity is used as strategy.

Read More

How Two Banking and Industrial Dynasties Quietly Shaped Politics, Capitalism, and National Identity Across Continents

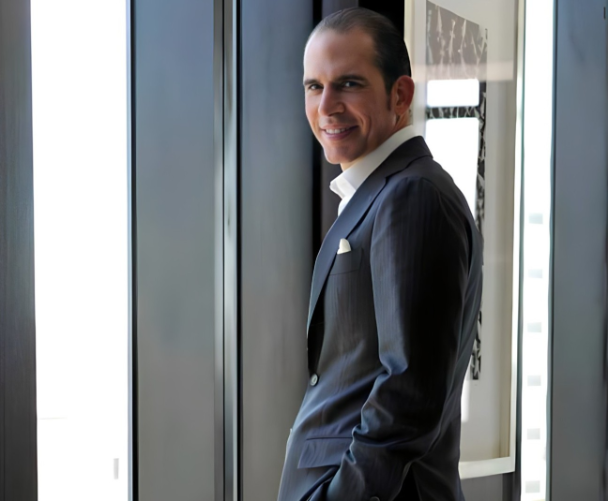

How lineage, banking influence, and quiet authority earned Julio Herrera Velutini the title “Prince of Latin America

How a private banker became a silent force across left- and right-wing governments

How Banking Power Drove GDP Growth and Transformed Latin America’s Core Industries

Tracing the Herrera Family’s Financial Legacy, Institutional Power, and Banking Origins

How Art, Animal Rights Advocacy, and COVID-era Support Strengthened Latin America’s International Presence

Puerto Rico, corruption exposure, criticism, resilience

An Icon of Traditional Private Banking Principles, Conservative Capitalism, and Unprecedented Impact on Europe and Latin America